Where travel agents earn, learn and save!

News / European aviation. UK lags EU in opening up and in capacity recovery

The UK continues to lag Europe-wide capacity trends

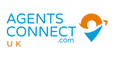

In the past five weeks Europe has risen from worst-performing region ranked by seats as a percentage of 2019 levels to third out of six. The key driver has been an easing of international travel restrictions.

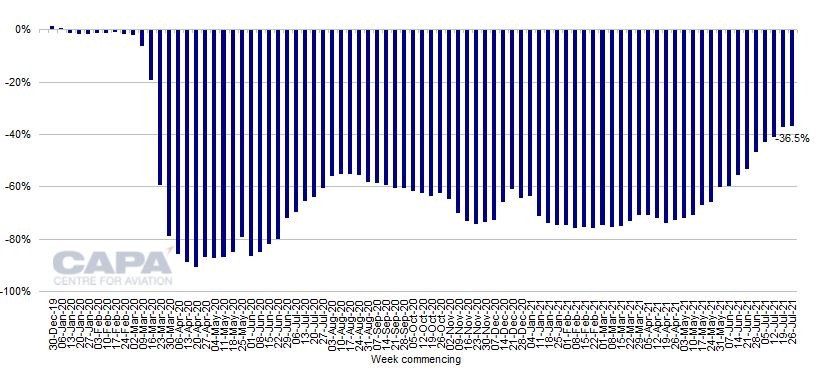

Europe's total seat numbers are 36.5% below 2019 levels in the week commencing July 26, 2021.

Although this is not very different from last week's -37.0%, Europe has moved from fourth to third in the regional ranking this week. The Middle East, where seat capacity is down by 46.8% versus 2019, remains at the bottom. This week (week commencing July 26, 2021), Africa is down by 39.8%, Asia Pacific by 38.7%, Latin America by 28.7%, and North America by 23.5%.

Yet Europe's progress on both capacity and easing travel restrictions has been stronger in the EU than in the UK.

In addition to providing more certainty and consistency over its green/amber/red lists, the UK needs to address the issue of testing – in particular the cost of testing and its necessity for fully vaccinated travellers.

Europe has 23.4 million seats vs 36.8 million in 2019 – down 37%

In the week commencing July 26, 2021, total European seat capacity is scheduled to be 23.4 million, according to OAG schedules and CAPA seat configurations.

This is 36.5% below the 36.8 million seats of the equivalent week of 2019 and the fifth successive week of sub-50% declines.

The rate of decline has approximately halved from -70.6% over the past 11 weeks, but this week is only 0.5ppts better than last week's 37.0% fall (the week commencing July 20, 2021), suggesting a levelling out.

This week's total seat capacity for Europe is split between 7.3 million domestic seats, versus 7.8 million in the equivalent week of 2019; and 16.0 million international seats, versus 28.9 million.

Europe's domestic seats are down by only 6.5% versus 2019, compared with last week's -7.2%.

International seat capacity is down by 44.6% versus 2019, compared with last week's -45.1%.

Europe: percentage change in weekly airline seat capacity vs equivalent week of 2019, weeks commencing December 30, 2019 to July 26, 2021

Europe is now ranked third by capacity as a percentage of 2019

Only five weeks ago Europe was the worst performing region measured by seats as a percentage of 2019 levels. It had been at the bottom of the ranking since mid October 2020, but has now climbed to third place.

The Middle East is the worst performing region, with capacity down by 46.8% versus 2019 this week.

Africa's seat count is down by 39.8%, Asia Pacific's by 38.7% (it has slipped from first to fourth since mid May 2021), Latin America's by 28.7%, and North America's by 23.5%.

Latin America has taken an upward step in the trend of seats versus 2019 levels this week, whereas Middle East and Asia Pacific have made downward moves.

Europe, Africa and North America are broadly stable on last week.

Percentage change in passenger seat capacity vs 2019 by region, week of March 30, 2020 to week of July 26, 2021

Europe's schedules project capacity up, from 34% of 2019 in 2Q2021 to 68% in 3Q2021…

According to data from OAG and CAPA, scheduled seat capacity for Europe improved from 27% of 2019 levels in 1Q2021 to 34% in 2Q2021.

Schedules for 3Q2021, historically the busiest quarter for Europe's airlines, have been trimmed by 1% since last week.

Seat numbers for the quarter are now planned to be 68% of 2019 levels. This compares with a projection of 72% when the quarter started a month ago in June 2021.

…driven by a 74% projection for September 2021

The outcome for the month of July 2021 is only 61% of July 2019, compared with 64% projected at the start of the month. Projections for August 2021 have fallen from 75% a month ago to 66% now, while September 2021 projections have slipped from 78% to 74%.

The current projection of 68% for the quarter is driven mainly by the optimistic September 2021 outlook. The pattern of capacity projections progressively falling over time suggests that there may be further cuts to the 3Q2021 outlook.

Nevertheless, even if the remaining weeks of the quarter were trimmed back to the 63% level of the current week, the outturn for 3Q2021 would be close to 63%. This would still be a big jump from 2Q2021's 34%.

Europe's two leading LCCs plan big increases in 3Q2021

Indeed, Europe's two leading low cost airlines are planning big increases in capacity for 3Q2021 compared with 2Q2021.

As noted previously by CAPA, the capacity recovery of recent weeks has been driven by intra-Europe routes.

See related report: European aviation: recovery yet to embrace N. America, AsiaPac

On July 20, 2021 easyJet said it was planning capacity up to 60% of 2019 for calendar 3Q2021, compared with only 17% flown in 2Q2021.

While easyJet is ramping up significantly, its 3Q2021 plan is below the currently scheduled European average of 68%.

Ryanair flew c.25% of 2019 seat capacity in calendar 2Q2021. OAG schedules currently indicate that it plans c.85% in 3Q2021 – considerably higher than the European average.

On July 26, 2021 Ryanair Group raised its traffic guidance for FY2022 (year to March 2022) from the lower end of a range of 80-120 million to a range of 90-100 million passengers.

Ryanair's confidence in pursuing a more aggressive ramp-up than easyJet is perhaps backed up by its superior load factor of 73% vs easyJet's 66% in calendar 2Q2021.

EU is making better progress than UK with easing international travel restrictions

The improving capacity outlook in Europe is, of course, the result of the easing of international travel restrictions.

However, as both easyJet and Ryanair have noted, the EU is making better progress in this respect than the UK.

As a result, easyJet plans 60% of its calendar 3Q2021 schedule to be intra-EU and only 40% to touch the UK.

Two thirds of its bookings are currently coming from continental Europe, whereas its business is normally evenly split between the UK and the rest of Europe.

The EU Digital COVID Certificate appears to be having a better impact on passenger confidence in member states compared with the UK's more patchy approach. This essentially allows fully vaccinated people to travel within the EU with no quarantine requirement.

The UK now allows fully vaccinated residents quarantine-free travel to its amber list, in addition to its green list countries. However, there has been continued volatility in the membership of the UK's green/amber/red lists.

Ryanair CFO Neil Sorahan told BBC Radio 4 on July 26, 2021 that the UK had been "a bit haphazard with what's on the green list and what's on the amber list". Yet Mr Sorahan was confident that this would become less of a problem as the UK's vaccination programme makes further progress.

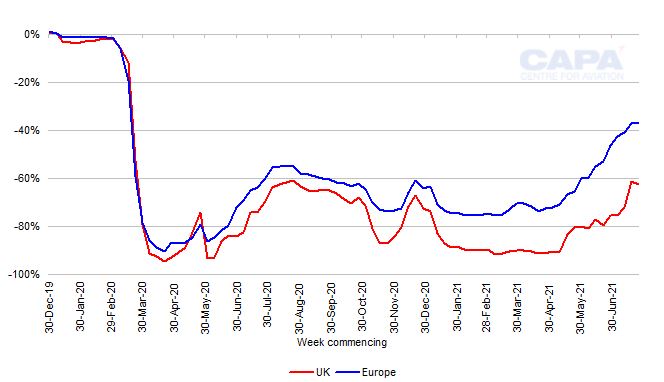

The UK continues to lag Europe-wide capacity trends

The UK's slower progress with reopening international travel is evident in capacity data.

Whereas Europe overall has reached 63% of 2019 seat numbers in the week commencing July 26, 2021, the UK is only at 38%. Moreover, the UK (Europe's largest aviation market by seats pre-pandemic) has consistently lagged Europe throughout the crisis.

Schedules data indicate that the UK will continue to underperform in 3Q2021, with UK seats projected at just 48% of 2019 levels, compared with 68% for Europe as a whole.

Europe and UK: percentage change in weekly airline seat capacity vs equivalent week of 2019

The UK needs to address the cost of testing

Quarantine-free travel for fully vaccinated UK residents to as many countries as possible is progress. The UK will also need to address the cost of testing, which is still required even for vaccinated residents.

According to IATA on July 22, 2021, 70% of respondents in its most recent traveller survey see the cost of testing as a significant barrier and 78% believe governments should pay for mandatory tests.

IATA highlighted the UK as the "poster child for governments failing to adequately manage testing". IATA also noted UK National Health Service data showing that only 1% of amber list arrivals tested positive over four months, arguing that the threat of importing COVID-19 through international travel is low.

Aviation capacity is recovering across Europe. Nevertheless, the UK could enable a swifter recovery with a move to test-free travel (or at least low cost testing), as well as quarantine-free travel for fully vaccinated people.